Volume Pressure Sharpens As Produce Inflation Climbs In August

September 15, 2022“Inflation has been accelerating since early fall 2021, drought conditions are severe, consumer confidence is low and grocery patterns are switching very rapidly. IRI, 210 Analytics and IFPA remain committed to bringing the industry the latest analysis in fresh produce,” said Joe Watson, VP, retail, foodservice and wholesale for IFThe August marketplace.

Food inflation remains extremely high and consumers are feeling the pain. They are making changes to their restaurant engagement as well as their grocery purchases, according to the August IRI survey of primary grocery shoppers.

- 81 percent of American households bought at least one restaurant meal in August, with the highest restaurant penetration among Gen X, at 85 percent.

- 54 percent have ordered meals to go. Half of American households have eaten restaurant food on premise. Additionally, 20 percent have ordered from a restaurant for home delivery. “Home delivery is much more popular among Gen Z and younger Millennials, at 31 percent,” said Jonna Parker, team lead fresh at IRI.

- When purchasing groceries, 85 percent of consumers shopped in person. Online shopping was near equally divided between click-and-collect (nine percent) and home delivery (six percent). Delivery is more prevalent among Gen Z and younger Millennials, at 13 percent.

- Spending continues to be affected by out-of-stocks.

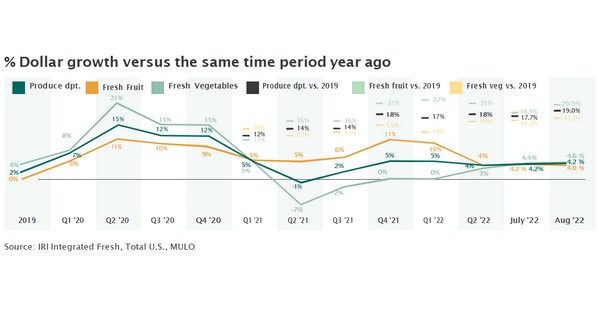

August 2022 fresh produce sales reached $5.9 billion, surpassing the record set the prior year by +4.2 percent.

“In the fourth quarter of 2021 and the first quarter of 2022, fruit grew much faster than vegetables,” explained Parker. “In July, fruit and vegetables came in at +4 percent dollar growth, each. In August, vegetable growth moved ahead of fruit once more.”

“The year-on-year growth in fresh produce (+4.2 percent) was far below the growth seen in shelf-stable and frozen fruits and vegetables in August,” said Watson. “This could be one of the signs of consumers moving into recessionary spending.”

“The overall volume pressure in fruit is echoed by nearly all the big sellers,” Parker said. “Berries, that have been an incredible pandemic powerhouse, fell 5.6 percent behind year-ago levels. The deepest volume declines among the top 10 players were measured among mixed fruit and mandarins, but avocados and melons also backslid significantly.”

“August’s vegetable performance was mixed,” said Watson. “While most top sellers increased dollar sales, only cucumbers experienced an increase in volume.”

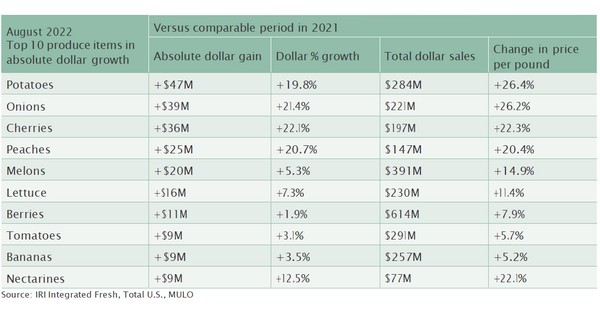

In August, fresh fruit added $119 million in sales and vegetables added $120 million when compared to August 2021. Potatoes, onions, cherries, peaches and nectarines each had inflation of 20 percent or more compared with the average price per pound in August 2021. Berries, tomatoes and bananas had inflation below the rate for total food and beverages and demand remained strong.

From Fresh Plaza